Strange Case of Dan Loeb and Daniel S. Loeb

Not to mention Mr. Pink...

“You came to hear my story, I guess,” says Dan Loeb.

It’s 2009, just past the worst of the financial crisis. Loeb is addressing a crowd of nearly 100 assembled at the Jewish Enrichment Center (JEC) in New York to witness that Loeb magic firsthand—and just maybe hear his famously sharp tongue in action.

“But there’s some great stories out there,” he says, deflecting. Loeb speaks haltingly, slowly; with what might even be described as care. He stands behind a podium, his bronzed skin peeking through the top of his unbuttoned shirt, belying a lifelong love of surfing and deep Southern Californian roots.

He’s recently read Rohinton Mistry’s novel A Fine Balance, he tells the audience, and it’s left an impression on him. Two of Mistry’s most interesting characters are from India’s lowest caste—two leather tanners. It’s an important lesson, Loeb explains. “I’m not saying [my story] is better or worse than anybody else’s story. It’s just another story.”

Dan Loeb has reason to be feeling high. It’s June 10th, the New York summer is still tolerable—perfect weather for his triathlon training—and Loeb’s hedge fund, Third Point LLC, is just starting to shake the doldrums of the 2008 recession.

As the crisis unfolded, Loeb’s assets under management tumbled by nearly two thirds. “I felt like [Third Point] was just slipping between my fingers,” he says later in the speech. But two months before, in April, he had taken a trip to Washington, D.C., to better understand the regulations put in place following the crisis. There, he recognized an opportunity deep within his circle of competence. Upon returning to New York, Loeb began hoovering up distressed debt from Chrysler’s finance arm, and from Ford, CIT, and Delphi, among several other bets. By the end of the year, Third Point would be up 45 percent.

Know your circle of competence, and stick within it. The size of that circle is not very important; knowing its boundaries, however, is vital.

— Warren Buffett

By the time of his JEC speech, he feels the tide turning. Dan Loeb is back on board.

Still, he opens the remarks with humility. “Everybody in the room” could tell a story about themselves, he points out. Perhaps Loeb is remembering his liberal arts days at Columbia College and the Aristotelian concept of ethos—the speaker’s imperative of building personal credibility with the audience. He would later say that the lessons he learned from The Iliad, from Plato’s Dialogues, from the Aeneid, stuck with him more than those of his major, economics. “You have to be a little bit of a philosopher to be a good investor,” he explains.

And it works—humble Loeb is disarming and affable. This Loeb, though, may look strikingly unfamiliar to America’s battered CEOs.

The appearance that I "called you out" on your underperformance and provided specific examples to disprove certain of your statements caused you to launch into such a tirade that even you found it necessary to apologize at the Conclusion of the conference call. I am beginning to wonder if you would benefit from anger management counseling or more specifically, if you are fit to run a company on behalf of public shareholders.

— Penn Virginia Letter (2003)

Sadly, your ineptitude is not limited to your failure to communicate with bond and unit holders. A review of your record reveals years of value destruction and strategic blunders which have led us to dub you one of the most dangerous and incompetent executives in America. (I was amused to learn, in the course of our investigation, that at Cornell University there is an "Irik Sevin Scholarship." One can only pity the poor student who suffers the indignity of attaching your name to his academic record.)

— Star Gas Partners Letter (2005)

Since you ascended to your current role as Chief Value Destroyer (‘C.V.D.’) when you assumed the formal title of C.E.O in 1999, the shares have dropped over 45%, a destruction of shareholder value in excess of $520 million.

— Potlatch Corporation Letter (2003)

I have known you personally for many years and thus what I am about to say may seem harsh, but is said with some authority. It is time for you to step down from your role as CEO and director so that you can do what you do best: retreat to your waterfront mansion in the Hamptons where you can play tennis and hobnob with your fellow socialites. The matter of repairing the mess you have created should be left to professional management and those that have an economic stake in the outcome.

— Star Gas Partners Letter (2005)

And as for that Greek humility?

We are an aggressive performance oriented fund looking for blood thirsty competitive individuals who show initiative and drive to make outstanding investments. This is why I have built third point into a $3.0 billion fund with average net returns of 30% over 10 years.

— Email exchange with Alan Lewis (2005)

But by whose measure? In my business, fund management, we are measured by the rate of return earned for our investors. (Our returns have been quite good, averaging over 35% per annum for over five years notwithstanding the drag from our investment in Agribrands.) From such an investor’s perspective the performance of Agribrands and Ralcorp has been dismal.

— Agribrands International Letter (2000)

Oh Lord He is Wise

— Mr. Pink on Dan Loeb on Silicon Investor (2005)

Loeb’s story, then, is not so easily pinned down. He is alternately the clairvoyant-Transcendental Meditation-practicing-yogi-philanthropist-family man devoted to creating a supportive company culture or a notoriously acid-tongued activist typifying the worst of Wall Street bro assholery.

Wherever you come down, Dan Loeb is worthy of study. Over the past 26 years, he has turned $3.3 million in start-up capital into a hedge fund with more than $20 billion. He personally pioneered a new era of activist investing. He has kept pace with the market’s rate of change, learning and growing in order to succeed even as the landscape has shifted repeatedly under his feet—yielding remarkable consistency. He has compounded at over 15% for over 25 years, creating billions of dollars in value for his investors. He has amassed a multi-billion dollar fortune himself and has been generous in giving it away in support of healthcare, education, and criminal justice reform causes.

Like so many great American stories, Loeb’s begins in California in the 1960s.

ORIGINS: We can do anything, right Dan?

Loeb hails from Santa Monica, California, where he grew up “almost bizarrely” fascinated with investing.

His great aunt, Ruth Handler had invented the Barbie doll in 1959 and with her husband Elliott, founded the toy company Mattel. As a result, Loeb came of age with a keen sense of the possibilities of entrepreneurship—which he explored repeatedly.

When he was twelve, Loeb had been inciting trouble with the junior high bullies, and hired a classmate, Robert Schwartz to be his bodyguard for 25 cents a day. Today, Schwartz is managing partner of Third Point Ventures, Loeb’s venture capital arm.

Later on, in high school, Loeb would start his own skateboard company.

At one point, Loeb began scrawling the name Third Point—that of his favorite surf break in Malibu—over and over. “Third Point, Third Point, Third Point” covered his pages, evidence of an early infatuation with finance—and the idea of running his own fund.

Loeb took his fixation a step further at Columbia, trading serious money outside of class. By his senior year, he had earned $120k ($310k in 2021 dollars) in profits. But he lost it all—and then some—in a single bad bet the same year. He had overconcentrated his position, leveraging up his stake and paying the price. His father—a corporate attorney—loaned him money to cover the tax liability of $7,000. Though it took him a decade to repay his debt, the episode imparted learnings that have lasted his entire career. “That was a 10-year lesson in the perils of leverage and overconcentrating positions,” Loeb says.

And indeed, Loeb has shown a perennial unwillingness to leverage Third Point’s positions. “If you take a 10 percent return in a security and lever it up four times,” he has said, “and after financing costs generate 15 or 20 percent returns, you haven’t increased your returns. You’ve just increased your leverage and significantly increased your risk... You’ve also got a 20, 25 percent downside thread.” In the early 2010s he reported that across Third Point’s entire portfolio, debt only amounted to 150% of AUM, lower than peer funds.

We look at everything on an unlevered basis.

— Dan Loeb, as quoted in The Alpha Masters (2012)

After graduating college in 1983, Loeb embarked on his formal finance career, starting with a tour of duty at private equity firm Warburg Pincus. There, as a mentee of John Vogelstein (who would later become Warburg’s vice chair), Loeb learned the basics of finance and then some, finding and pursuing a deal that would earn the firm $20 million in profits. Loeb benefited from the exchange as well, learning from Vogelstein’s business savvy and from his “unequaled integrity.”

Over the ensuing decade, Loeb worked on both the buy and sell sides of the industry, including a stint at Island Records (U2 and Bob Marley’s record label), where he helped to secure a debt financing deal; a stop at the hedge fund Lafer Equity, where he learned the skills of the trade; and Jefferies, where he worked on the profitable bankruptcy financing of Drexel Burnham Lambert, which was famously forced into bankruptcy in 1990. His last stop before setting out on his own was Citicorp, where he sold junk bonds. Each experience helped Loeb build a circle of competence around distressed assets—expertise which would set the stage for the rest of his career.

Despite distinguishing himself early on, Loeb’s upward trajectory wasn’t monotonic. At one point, sometime following his Island Records tenure where he says he learned the importance of “getting out in the world,” Loeb was forced to do just that. Dan Loeb found himself out of work, crashing on a friend’s couch. And, as he searched for a new job for the next nine months, Loeb experienced a feeling he hadn’t since his college days: failure. “I know what it's like to really want to get into something, [and] feel you have doors just being shut to you left and right,” he has said of this period. “Every day was a job looking for that job.”

By 1995, after a decade in finance, Loeb was ready to strike it out on his own. So he hung his shingle in—of all places—the weight room of noted hedge fund manager David Tepper’s New Jersey offices (Loeb had cold called Tepper three years earlier when he was Jefferies, the beginning of a long relationship).

Loeb had set out to raise $10 million dollars to start Third Point, but was only able to cobble together $3.3 million, including $250,000 dollars of his mother’s money (“She doesn’t have a lot”) and $340,000 of his own capital—his entire life savings to that point.

Yeah but my expectations were low so the fact that I had $3.2 million seemed like a big win. In fact the weight of being responsible for that much capital was almost overwhelming to me the days before “we” launched. My goal was to one day manage $20 mm which I calculated was enough to support me and a family beyond my dreams. I wasn’t burdened by a fancy pedigree, high expectations or much of an attachment to material things so I could focus on my passion for investing, which to this day rarely feels like work and is still tons of fun.

— Dan Loeb on Twitter (2021)

Dan Loeb was set to commence trading on June 1st, 1995. But the night before, Loeb faced a crisis of confidence.

Loeb, the saber-penned tiger of Wall Street, felt like an imposter: what if he couldn’t deliver? His family and friends had trusted him with their hard-earned money. He had even put a down payment on a new house and would now have mortgage payments. “I said, ‘this is crazy,’” Loeb remembered.

But the Third Point wave was about to break. There would be no option now but for Loeb to find his footing.

And after the first month, Third Point was up 8%. “I didn’t have that fraud feeling again,” he said.

Loeb worked hard to keep his costs low, demonstrating the kind of fiscal restraint he would preach to negligent CEOs over the next two and a half decades. His rent to Tepper: $1,000 per month. He installed a single, creaky desk in the space and performed all of his own marketing, investor relations, and administrative tasks himself.

It took Loeb five years to reach $100 million in AUM from Third Point’s $3.3 million start. But things really started taking off after the internet bubble burst, which Loeb correctly shorted. By 2003, Third Point had made it to $1 billion under management.

ACTIVISM: “Very truly yours”

Mr. Pink

Loeb built up Third Point with a portfolio well within Loeb’s circle of competence; risk arbitrage positions, distressed debt, and high-yield bonds. “The secret to our success,” Loeb would later say,” is congruence between our investment style and my personal investment style and philosophy, the fundamental elements of which have remained constant over almost 18 years.”

The Third Point/Loeb approach is defined by an “event-driven situation” hypothesis—that is, Loeb picks positions based on expected bankruptcies, restructurings, or other major events that he believes will move prices. At the beginning of Third Point’s run, such events were expected to be endemic to the market. Later, its investment philosophy would expand to include events precipitated by Loeb’s own action.

As Loeb grew Third Point, his circle of competence expanded in step, as did his innovations. Early on leveraged the internet in order to learn and share ideas with fellow investors. Over time, Loeb built a platform which he used to pioneer a new style of activist investing, informed by research as thorough as his use of it was brash. His letters would include pioneering investigations of executives' use of private jets, their personal use of corporate cars, and their time spent on golf courses.

It all began with an investing forum regular who went by the name of Mr. Pink.

Mr. Pink—the character from Quentin Tarantino’s film Reservoir Dogs who steals diamonds and leaves his co-conspirators for dead—has posted nearly 19,000 times on the forum site Silicon Investor since opening his account in 1996. “Mr. Pink,” reads the account’s bio, “shares his wisdom on such diverse topics as spin-offs, mutual thrift and insurance conversions, merger arbitrage, post-bankruptcy equities and short ideas. Mr. Pink does not lie.”

And indeed Mr. Pink does not. In his early days, Loeb-cum-Mr.Pink developed a reputation for frank mud-slinging, which he refined to a science on the platform, earning him a substantial following.

He also won devotees for his lucrative “Mr. Pink’s Picks.” Many were examples of Loeb distressed asset specials.

Like Euripedes' Trojan Women, market participants have awoken from a financial Bachanal. Some have awoken wondering "what have I done" while others are still trying to sleep off excesses from the celebration. Soon the financial crisis in Russia will set off more than just rumblings in other economies, Japan, Asia etc. will face further collapse. Liquidity will dry up like an old whore. The individual investor will seek safety and escape the market and redeem 401k programs. Many will default on credit card debt used to buy margined securities. In September, hedge funds shall face massive redemptions followed by more at the end of the year. War will break out in some other unsuspecting terrorist based country.

— Mr. Pink on Silicon Investor (1998)

TO ALL: THIS IS A PINK DADDY SPECIAL ANNOUNCEMENT

NEW IDEA---------FA FA FA FA FA FA FA FA FA FA FA FA FA

Mr. pink is back with a Pink pick Fairchild Corp.

Heres the deal: Fa has 20 mm shares out and trades around 21 value of $420 mm bucks plus $150MM in debt for an enterprise value of $670mm.

the company is spinnin of business with real estate ($50MM book) a Turkish canning company 32% stake (worth 45MM after tax) and a semiconductor capital equipment company $100mm revs no profits value at zero. so spinco is worth roughly $4.52/ share. The remaining busines consists of 17 MM shares of Banner Aerospace which trade at 10 bucks ($170MM), and a fastener business which did $290mm in sales in trailing 12mos but should do EBIT of 45MM in fy ending 6/30/98....

— Mr. Pink on Silicon Investor (1997)

In an apparent act of desperation First Plus announced that it had retained investment bankers and is seeking the sale of the company. Mr. Pink believes the reason for doing so is that the company lacks liquidity to continue as a going concern.

The securitization market upon which the company is reliant has all but dried up and the company will not be able to continue its business with out such access to the capital markets.

In addition, the company generates significant negative cash flow and shows profits only due to the use of controversial gain on sale accounting.

Furthermore the company's balance sheet is like a toxic waste dump of Interest Only strips, "B pieces" of financings, mysterious "other assets". Remember when Conseco bot Greentree, they took 600mm of losses as a charge.

— Mr. Pink on Silicon Investor (1998)

As Mr. Pink, Loeb learned to engage his audience, honing a dark, insouciant wit. His posts read as proto-Tweets—bites of entertainment as much as vessels of information. The forums provided Loeb an opportunity to iterate; pushing the bounds of social acceptability and getting instant feedback. And decades before Wall Street Bets, Mr. Pink’s posts inspired market-moving action from his readers, earning scrutiny from regulators.

Transition to 13D

After reading Robert Chapman’s watershed activist letter to the chairman and CEO of American Community Properties Trust lambasting his company as being run like a “real-life version of monopoly,” Loeb saw a glimmer of opportunity. He began pivoting his online prowess to activist letter writing.

Loeb’s letters would be filed as amendments to form 13D, a disclosure required by the SEC of any entity acquiring more than 5% of a public company. In his own first 13D, filed in September 2000, Loeb came out swinging against Bill Stiritz, the well-respected CEO of Agribrands, a pet food and animal feed conglomerate—accusing him of self-dealing and pushing a rotten merger.

Specifically, during fiscal 1998 you were awarded options on 1.0 million shares, or over 10% of the company's float, based on today's share count. You were then awarded options on an additional 500,000 shares (another 5% of the company equity) in the beginning of fiscal 1999 after concerns about the Asian crisis drove the share price down to a temporary panic level of $21.00 per share. This award was granted just prior to the announcement on September 25 of the companies authorization of a 2 million share buy back and prior to the October 28 announcement of the quarterly results for the period ended August 28, 1998 in which the company substantially beat analyst expectations.

One can only assume that you had prior knowledge of both these events when you were awarded the second round of options. While the proxy statement makes reference to external compensation consultants and the use of a Black Scholes model, neither of these safeguards could have been factored in the market panic or the information that you likely possessed when you chose to set the option exercise price….

Your track record in taking steps to enhance shareholder value has been singularly unimpressive. You have not demonstrated the ability to significantly increase the value of either of these companies as independent concerns. Why should shareholders conclude that a merger of these two companies, with no synergies between them, under your continued leadership, would somehow improve their position?

— Agribrands International Letter (2000)

Loeb’s tactics raised eyebrows, but proved successful. His agitation earned him a $20 million return. Buoyed by this experience, Loeb became expert in roasting small-cap CEOs. Though these notorious letters brought him fame, he continued posting as Mr. Pink on forums, and in a few notable cases, transcended the medium of written word entirely.

Video produced by Loeb for a Campbell’s soup activist campaign (keep your eyes peeled for a Loeb cameo).

Successful activism relies on the capacity of the investor to induce a change at a target company. In his JEC speech, Loeb refers to three primary means activists use to do this: first, financial levers. Investors can use “financial muscle in one way or another,” including going so far as to acquire a controlling stake in the company. The second means is legal—lawsuits and proxy battles are primary methods here. Finally: social pressure, or ridicule. This is how Loeb gets his desired outcomes: forcing action through public shaming.

Loeb arguably understands how to lever this mechanism better than anyone else in the industry. Let’s look at a prototypical example.

Anatomy of a Loeb Letter

In 2004, Loeb wrote the following to John Collins, the chairman and CEO of InterCept, a technology services vendor:

“Dear Mr. Collins:

Third Point Management Company L.L.C. ("Third Point") is the advisor to entities that have acquired 1,450,000 shares of InterCept Inc. (the "Company") representing an interest of 7.1%. Do not confuse our $22 million stake as a vote of confidence in the Company's senior management or its Board of Directors. On the contrary, it is our view that your record in management, acquisitions and corporate governance is among the worst that we have witnessed in our investment career. It is further apparent that the current Board of Directors represents the narrow interests of the management instead of the shareholder base as the law requires of fiduciaries.

Loeb chooses violence from the outset, setting his brutal denunciations “your record…is among the worst” against the buttoned-down, legalistic prose typical of such disclosures. Here, he follows the dictum of knowing his audience and writing for their benefit. Fellow hedge funders say that they admire Loeb for his willingness to speak the normally unspoken part out loud. It helps that Loeb’s letters are wildly entertaining to read—particularly if legalistic prose is typical fare.

Also evident is Loeb’s personal glee in using pro forma style to take down underperforming managers. In fact, he had a collection of his letters sent to his high school English teacher.

Loeb’s format flippancy continues throughout: eg. “The Company's proxy statement provides us with our first indication that a ‘good ol' boy’ (‘GOB’) set of ethics prevails at the Company rather than standards dictated by fairness and good judgment.”

Beneath the outrageous style and brazen insults (which, not incidentally, tend to steal the lion's share of news coverage about Loeb’s letters) sit carefully researched and meticulously argued cases. Taking the principle, again, of writing for humans rather than lawyers, Loeb homes in, with crackling indignation, on instances of dubious dealings and brazen nepotism. Some call it ‘hedge-fund populism’.

First, the Company employs the CEO's daughter, Denise, and her husband David Saylor, who received total compensation of $238,776 in 2003. I called Mr. Saylor last Friday at 4:00 p.m. at the Company's offices to learn more about the core product that he presumably sells. He had his calls forwarded to his cell phone since it was still business hours. I identified myself as a shareholder interested in learning about the core product lines to which he replied that he could not speak as he was ‘on the golf course.’ I was not sure whether it was his relation with his father-in-law or the $238,776 salary that affords him the opportunity to work on his golf game during business hours.

Make no mistake, Loeb seems to say, ‘I have done the research. There is no hiding from the truth.’ Investigations such as this—relying on phone calls, research into professional and family backgrounds, and deep looks at dubious financial arrangements—figure prominently into Loeb’s letters. His methods ushered in new ways of tracking corporate productivity and malfeasance. For example, Loeb helped to pioneer the practice of tracking executives’ use of private jets.

We also learned that the Company leases a private jet from a partnership controlled by CEO John Collins and fellow board member Glen W. Sturm(1), a partner at Nelson Mullins Riley & Scarborough LLP ("Nelson Mullins"), a firm that also received millions of dollars of legal fees from the Company over the past several years. This cozy relationship gave us pause and caused us to wonder how Mr. Sturm and the Nelson firm could represent the interests of shareholders given the gravy train of legal fees earned by the firm and the fact that Sturm and Collins could potentially be tooling around in a luxurious business jet, possibly sipping Cristal Champagne cocktails at shareholder expense.

It is in this milieu, revealing the luxury habits of low-performing CEOs, that Loeb the storyteller is at his strongest. The letters read like white-collar crime dramas; the aesthetic of misdoing usually outweighing the severity of the accusations themselves.

Loeb is highly conscious of his use of strategic framing in his letters.

I have to say, if I can take credit for a couple things. I was the first person to really use the existence of corporate jets to bash these guys over the head. And sometimes I'd find these guys with the worst beat up 1970s citation 4-seater and I'd refer to their tooling around in their luxury jets drinking champagne cocktails and drinking and eating shrimp.”

— JEC Speech (2009)

In a letter rife with flippancy, the imperative of establishing rhetorical credibility is high; the risk of appearing to be a profit-seeking mudslinger is high. Loeb is expert at framing his own character as one of a diligent, concerned shareholder simply seeking information—only to bump up against staggeringly incompetent and unresponsive management.

Unable to reach Mr. Collins, even after leaving numerous messages on his voice mail and with his secretary, I was ultimately able to reach Carol Collins, who described herself as "acting chief financial officer, treasurer and head of investor relations", to inquire about the background of the transaction with the CSFB Affiliate. Given the plethora of firms that are able to provide financing of this nature, we were further surprised to learn that no other firms had been approached to provide a competitive financing package.

Underpinning the entertaining style sits a linear fact pattern, clear and carefully constructed.

I asked which financial firm advised the board and was told that no financial advisor was used. Instead, Company's legal counsel, Nelson Mullins, had blessed the transaction. I was incredulous: how could Sturm or one of his partners negotiate the terms of such a transaction in the interest of the shareholders when his firm is ultimately compensated by generating significant fees and when he himself introduced the deal?

In this letter, Loeb charges that Intercept CEO John Collins has dealt himself a sweetheart agreement at the expense of shareholders. Loeb proceeds with his “Investigation” by examining the backgrounds of several members of Intercept’s board whom he wishes to disqualify.

The Investigation has raised significant concerns about the business judgment of certain members of the Board of Directors, which extends to serious doubts about Mr. Collins ability to carry on acting as CEO.

Loeb’s ear for populism leads him to decry a recent deal in which the company went into payment processing for pornography. He picks the most extraordinarily salacious parts of the company’s dealings in the space, including “Midget Sex Zone” and uncomfortable attention from the Michigan Attorney General for allegedly providing payments services for child pornography.

He ends with a call to action, a must for any persuasive piece of rhetoric. He demands that the company be sold.

Third Point manages over $1.1 billion in capital; the InterCept stake represents less than 2% of our capital under management. We have the financial wherewithal to substantially increase our position and the staying power, if necessary, to continue to apply pressure until such time that we believe that a majority of the Company’s Board seats are controlled by people who, in our view, are able to sell the company.

We and other shareholders will hold you accountable for any further destruction in value that results from your inaction on the matter of the sale of the Company.

Very truly yours,

Daniel S. Loeb

“Sometimes,” Loeb has said, “a town hanging is useful to establish my reputation for future dealings with unscrupulous CEOs.”

RETURN TO THE CIRCLE: “Lucky 13”

By 2007, Loeb had built a reputation as a consistent manager, having delivered over 23.1% net annualized returns since Third Point’s founding. But a storm was brewing. Loeb managed to correctly spot the risk—engaging in a series of risk arbitrage transactions that netted the firm over $100 million in profits as the markets began to slide. But as Third Point’s investors found themselves suffering from liquidity shortages, many pulled assets from Third Point, causing the fund’s assets under management to fall by more than two thirds—from $5.5 to $1.7 billion, $1.4 billion of which was from investor redemptions.

I just thought God, you know, lucky 13. I spent 13 years building this business. And I felt like it was just slipping between my fingers. The organization was demoralized, I had huge overhead, and things didn’t look good. Then the redemptions started coming in.

— JEC Speech (2009)

Many other hedge funds chose not to allow redemptions at the height of the financial crisis, an industry practice called ‘gating’. Third Point took the opposite tack, allowing redemptions as needed. Loeb reflects on this moment as crucial in the life of Third Point, because even while AUM fell, Third Point’s relationships grew stronger.

Many funds that chose to ‘gate’ put the interests of their management company and its fee-generating ability above their most precious asset—their investors’ partnership. They put their own interests above those of their investors. And I think many of those funds are languishing now regardless of their performance because they violated their partners’ trust.

— Dan Loeb, as quoted in The Alpha Masters (2012)

The crisis also presented an opportunity for Loeb to return to his circle of competence. He spotted several opportunities, even early on in the crisis, for his background in distressed assets to shine. During downturns, he wrote in his 2007 Q3 investor letter, “it is important to not become too glum or defensive but to move quickly to capture inefficiencies and to be a bit greedy while your competitors grow fearful.”

Of course, the worst was still to come, with the collapse of Bear Stearns in March 2008 and Lehman Brothers bankruptcy in September of that year.

By the beginning of 2009, Loeb felt confident that the crisis had hit its trough. “In recent weeks,” he wrote in his April 2009 letter, “we have become less pessimistic about the state of the economy.”

He also touted several “distressed debt stakes” in the letter, which he says “are cheap and have defined near-term catalysts.” He refrains from detailing Third Point’s precise positions, though, inviting investors to call anytime to discuss. These positions would define Third Point’s response to the financial crisis and set the course for the fund’s success into the next decade.

During a pivotal trip to Washington, D.C., Loeb met with consultants, lobbyists, and other players familiar with new government stress tests of financial institutions, he recognized upside potential in insurance companies, including the Hartford Group, and big banks like Bank of America and Citigroup.

His core bets, though, were investments in distressed debt—which he purchased from Ford, Chrysler finance company, CIT, and Delphi. He also waded into mortgage-backed securities, which other institutions were staying far away from and which he believed to be underpriced as a result.

And then I, this was also kind of a leadership thing. I got the group together. I said, Guys, no more meeting with economists. No more talking about interest rates, steepeners, or currency trades. This is our set of what we do. It's a relatively narrow set and I want you to look at trust preferreds and banks, and I want you to look at risk arbitrage deals and bankruptcies.

— JEC Speech (2009)

As a result of these new positions, things were beginning to turn around at Third Point. “The investors are excited again,” he reported in his June JEC speech. “The team is energized. And I can tell a story to prospective investors such that the outflows have shifted to inflows, and it’s all about staying alive to fight another day and I’m enjoying what I’m doing again, a lot.”

STEPPING OUT EAST: “The Obscured Value in an Iconic American Technology Asset”

If Loeb’s actions during the financial crisis were defined by a return to his circle of competence, Loeb’s success over the next decade would be shaped by his willingness to push its bounds in search of value. One notable episode begins with Third Point taking a stake in Yahoo, the long-beleaguered search giant.

By September 8, 2011, Loeb wrote to Yahoo!’s board of directors informing them that he would be seeking their imminent replacement.

Dear Ladies and Gentlemen:

Third Point LLC (“Third Point”) is a registered investment adviser with approximately $8 billion under management. We are writing to inform you that certain investment funds we manage have acquired a 5.1% interest in Yahoo! Inc. (the “Company” or “Yahoo”), bringing our holdings of common stock and currently-exercisable equity options to 65,000,000 of the outstanding shares, and positioning us as the Company’s third largest outside shareholder.

This letter details our principled demands for sweeping changes in both the Board of Directors (the “Board”)...

— Yahoo! Letter (2011)

The letter is notable for Loeb’s virtual cordiality: Yahoo “has been severely damaged,” he writes, “but not irreparabl[y]—by poor management and governance.”

He proceeds by lambasting the board’s recruiting—and slow firing—of Carol Bartz as CEO and its resistance to selling the company to Microsoft. Mismanagement is hardly an unusual target for Loeb, though. More unexpected is Loeb’s reference later in the letter to Yahoo’s substantial stake in a Chinese technology firm with a then-dubious reputation: Alibaba Group.

After a troubled foray into the Chinese search market, Yahoo had decided to partner with a local firm to provide search services to the Chinese market to supplement the email and instant messaging products it offered there. In 2005, Yahoo founder Jerry Yang inked a deal with Jack Ma to buy 40% of Alibaba for what at the time was a shocking sum—$1 billion.

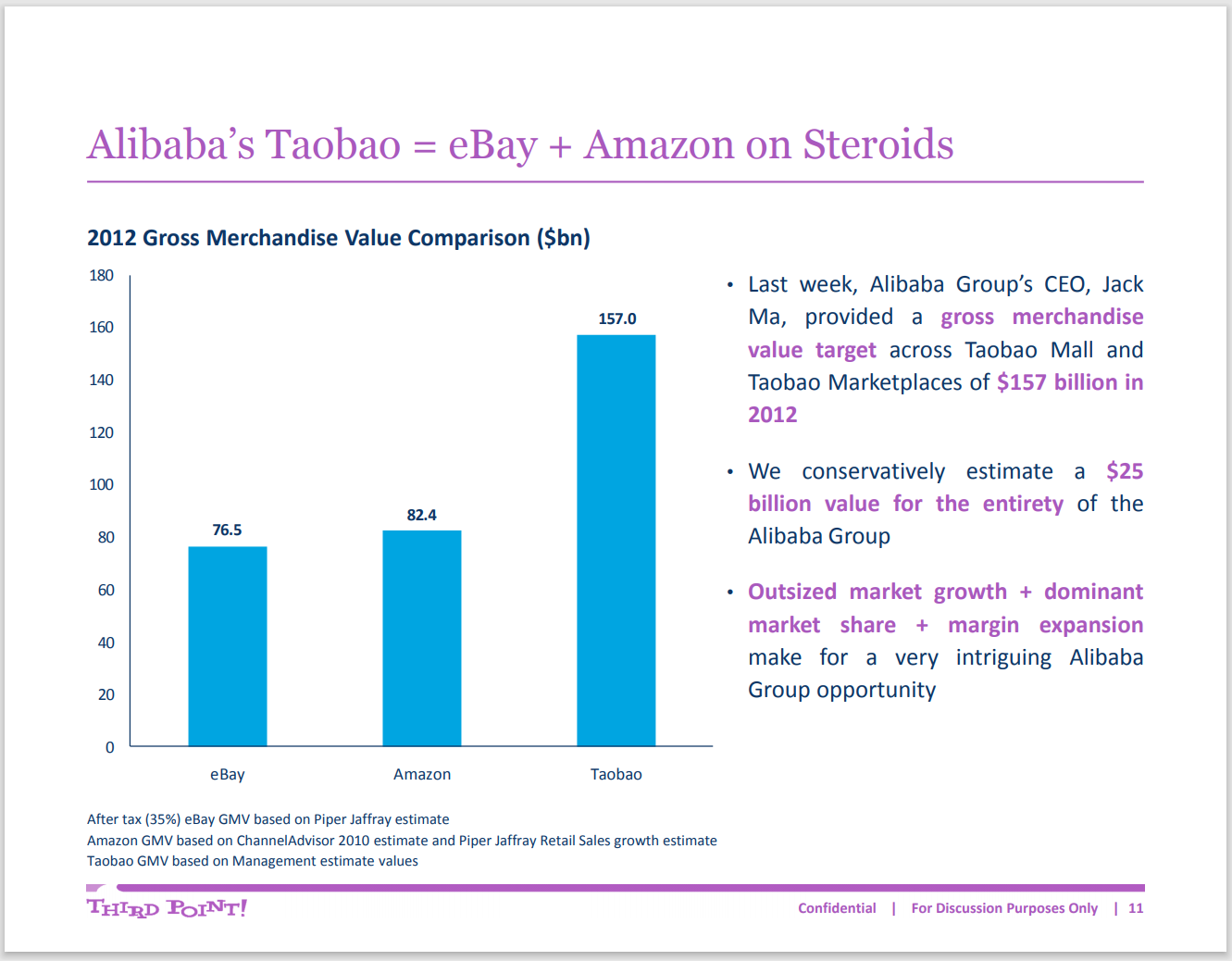

Six years later, Loeb terms Yahoo’s Alibaba holding “The Obscured Value in an Iconic American Technology Asset.” Alibaba, Loeb believes, is well positioned to benefit from the exploding Chinese e-commerce market. He would later say that this was the reason for Third Point’s Yahoo purchase. “We currently estimate a pre-tax value for Alibaba Group of $25 billion,” Loeb writes in the 2011 letter. “Given Alibaba Group’s growth potential and market share, it is entirely conceivable that Yahoo’s 40% fully diluted stake in Alibaba Group could double in value over the next 2-3 years, highlighting its tremendous value.”

Our investment in Yahoo! was also driven primarily by our interest in buying a high‐quality business, Alibaba, in which Yahoo! held a substantial stake at an extremely attractive price.

— Third Point Investor Letter Q2 2020

*For a more in-depth understanding of Alibaba, consider subscribing to KG’s DJY Research. Yesterday, they just released a 24,000 word deep dive into Alibaba that will explain the business, competitive dynamics, and the current investment case.

For an example of what to expect, check out their previous writeup on Sea Limited.

Loeb was, of course, right on the money. Alibaba’s value would grow nearly 10-fold by the time of its 2014 IPO (3 years and 10 days after his he published the letter).

At the time, Loeb laid out his case for Alibaba via Yahoo with a colorful presentation for the board.

Loeb further explained his interest in Alibaba in his investment letter from Q4 of that year.

According to iResearch, Alibaba currently has 49% of the B2B e-commerce market (four times greater than its nearest competitor), 90% of the C2C e-commerce market (analogous to Ebay), and 53%of the B2C e-commerce market (analogous to Amazon) in 2011. It has completed these core commerce positions with the leading online payment platform, Alipay, with 49% market share, and also holds the #2 share of the Chinese online ad market (17%, behind Baidu at 28%). Particularly exciting is Alibaba’s share of China’s rapidly growing B2C market represented by Taobao Mall, or Tmall (recently renamed Tian Mao).

— Third Point Investor Letter Q4 2011

Loeb’s position in Alibaba by way of Yahoo marked a departure from Third Point’s signature investments in small-cap companies and distressed assets. Alibaba sits about as far from Loeb’s (then-Madison Avenue, now Hudson Yards) offices as it did from his circle of competence.

But led by his nose for value, Loeb’s step out East would prove wildly successful. So much so that Loeb would be in and out of Alibaba repeatedly over the next decade.

His perennial BABA trading over the decade, always driven by events, marked a new kind of investment for Loeb, and an extraordinary statement of his belief in its value. Never before had he reinitiated positions in a single company so many times over such a long time horizon.

Just as he recognized value in Yahoo’s holdings in Alibaba, Loeb recognized that Alibaba’s hidden value lay in its subsidiary businesses. In his third quarter 2014 investor letter, Loeb laid out his case for Aliyun/Alibaba Cloud computing, China Smart Logistics (Alibaba’s logistics arm), and AliPay, Alibaba’s payment service.

The common factor in all three hidden assets is that they are underappreciated relative to Alibaba’s core free cash flow machine because they are only beginning to make money. We have seen Alibaba’s pattern for growing businesses and believe that they are inclined to focus on share over profits until they reach enormous scale. Once a business achieves ubiquity, profits can ramp very quickly. We believe that Alibaba’s $200 billion enterprise value (adjusted for public stakes) suggests we are getting valuable call options in Aliyun, China Smart Logistics and AliPay/Ant Financial for free.

— Third Point Investor Letter Q3 2014

By 2017, Alibaba’s market cap was approaching $400 billion and Third Point reinitiated its position. At this point—in his Q2 2017 investor letter—Loeb argued that changes to Alibaba’s advertising model presented an “important catalyst for meaningful revenue acceleration over the next few years.” By the end of the next quarter, Third Point’s in BABA would be worth $1.1 billion.

We believe that Alibaba is among the best business models in the global internet sector and is the clear winner in the consolidated Chinese ecommerce market.

— Third Point Investor Letter Q2 2017

Loeb’s repeat positions in Alibaba marked a re-calibrated approach. For one thing, Alibaba was one of the first major positions that Third Point had built in an Asian company.

Though it wouldn’t be the first time Loeb had taken positions in high-quality companies (others over the years have included Visa, Adobe, and Salesforce), Third Point’s position in Alibaba marked a meaningful departure away from his typical activist targets (small caps specifically) and towards buy-and-hold, high-quality companies, which he terms “compounders”. Even if Third Point had had the requisite capital to acquire a meaningful stake in Alibaba and if Loeb had thought management changes were necessary, by virtue of him holding an ADR (American Depositary Receipt) in Alibaba, he didn’t technically own the company and his ability to agitate for changes in corporate governance would have been greatly reduced.

This was a different kind of play. In a 2020 investor letter, Loeb explained his evolving philosophy.

In 2010, I remember sharing with investors at our annual event the quotation attributed to John Maynard Keynes: ‘When the facts change, I change my mind. What do you do, sir?’

Categories are important and central to how our minds make sense of a complex world by structuring and holding disparate information in our brains. Third Point was founded originally as an “event‐driven, value‐oriented” strategy that specialized in both credit and special situations such as spin‐offs, demutualizations, and post‐reorg equities. Over time, we developed the additional skill of creating our own events through activism. By structuring our funnel of ideas around these categories, we could easily prioritize our research process toward companies that were undergoing or could be catalyzed into making some sort of financial or operational “event”. As markets have changed, I have realized that while event‐driven is still an essential investment lens (clearly, as our two largest investments, Pacific Gas & Electric and Prudential plc, are both event‐driven situations that together comprise nearly 20% of our exposure), today, quality is also an essential screen.

...To be clear, investing in compounders and event‐driven situations are not mutually exclusive activities. It has been our experience that our event‐driven focus provides us with a unique window into the creation or evolution of a quality company, since they are often born out of corporate events or management changes. As we discuss in the equity section below, recent market dislocations have created several unique opportunities for us to acquire more of these kinds.

— Third Point Investor Letter Q2 2020

In that same 2020 letter, Loeb announces yet another reinitiated stake in Alibaba, this time driven by his bullish view of Alibaba’s cloud computing business, and of its 33% stake in Ant Financial, which was set to go public by the end of the year.

Third Point has exited BABA as of first quarter 2021, likely due to Ant’s IPO falling through as well as rising anti-monopoly regulations in China.

For a fresh take on BABA’s investment merits, check out KG’s DJY Research, which just published an in-depth research report on the company.

First 30 people to email us will get 10% off a subscription.

Loeb’s relentless search for value, even far afield—both geographically and philosophically—led him to first recognize value in Alibaba. At the time, in 2011, his was a contrarian case. Many other smart observers were dismissing Alibaba and Taobao as disreputable companies purveying fake Chinese goods. Loeb saw past this.

Recognizing that valuable embedded business within other companies would lead those companies to be undervalued (Yahoo in this case) echoes an approach he first took with internet companies in the 1990s.

Instead of focusing just on new internet companies, we bought a bunch of old-line companies that had internet companies embedded within them and we did quite well without taking the risk attendant in purchasing shares of high-flying overpriced internet companies.

— Dan Loeb, as quoted in The Alpha Masters (2012)

In Yahoo, Loeb thought he had found a great target for activism. Instead, he found his way into Alibaba, a company that led him to learn and evolve his investing philosophy. It also led him East for the first time.

You won’t understand markets in general unless you know where China is going. It’s essential.

— Dan Loeb, as quoted in The Alpha Masters (2012)

Third Point’s later positions in Chinese companies would include a 2016 Didi buy (then a private company) and a 2020 position in JD.

RECENT POSITIONS

The Happiest Place

In Q2 2020, Loeb announced that Third Point had taken a position in a company closer to home. Perhaps inspired by the Disney nostalgia from his L.A. childhood or perhaps driven by a COVID-related downgrade of the stock and his conviction in the growth potential of Disney+ (definitely the latter), Third Point built a position in Disney now worth $730 million, or roughly 0.2% of the company.

In less than nine months, Disney+ attained 60 million global subscribers, a milestone that took Netflix over seven years to meet.

— Third Point Investor Letter Q2 2020

Though a classic event-driven buy, Third Point’s Disney stake is representative of Loeb’s shift to compounder businesses. Though in this case the business had been compounding more than he preferred. In October 2020, Loeb opened his notorious poison pen drawer to author a letter to Disney’s new CEO, Bob Chapek, advocating for an end to Disney’s dividend payout.

Since its founding, Disney has been defined by its creativity, bold vision, and prescient grasp of the future of entertainment. We share the view that Disney is embarking on one of the most important transitions in its history: shifting distribution of the world’s most iconic entertainment brands from the box office to the home. Disney+ has made admirable early progress. Before launching Disney+, management demonstrated laudable vision by rolling out a multi-billion-dollar investment plan that exchanged near-term earnings for long-term value creation…

Loeb devotees may be forgiven for wondering where the castigation begins. But it never does—the Loeb poison has lost a bit of its bite. In fact, Loeb seems to want to ingratiate himself with management. His Chapek letter is distinctive not only for this reason (eg. his un-Loebian use of the adjectives “laudable,” “admirable,” and “constructive”), but because CEOs opening letters from activists can typically expect demands for increased dividend payouts rather than the opposite.

Redirecting its $3 billion annual dividend payout to content production, Loeb argues, would “double…[the] Disney+ original content budget. These incremental dollars would, based on our analysis, generate returns that are multiples of the stock’s current dividend yield by driving high life-time value (“LTV”) subscribers to your DTC platform.”

Loeb’s argument is linear and clear as ever.

Beyond bringing additional subscribers onto the platform, increased velocity of dedicated content production will deliver several knock-on benefits spread across your existing base including elevated engagement, lower churn, and increased pricing power. To put this in perspective, improving Disney+ churn to Netflix’s industry-leading ~2% domestic churn levels would more than double gross subscriber LTV. When combined with driving pricing to Netflix’s current $13 domestic average monthly price, gross LTV would quadruple to nearly $500 per subscriber. Together the ability to drive subscriber growth, reduce churn and increase pricing present the opportunity to create tens of billions of dollars in incremental value for Disney shareholders in short order, and hundreds of billions once the platform reaches larger scale.

The case is as compelling as it is simple: his proposed investment in content will increase user engagement, help with subscriber retention, and make it possible to charge more. This section even includes a hint of humble Loeb— “you have better insight [into the math] than we do,” he acknowledges when making rough projections.

At one point, Loeb even demonstrates charity.

While some pundits have described the Mulan release as a “debacle” due to the $29.99 cost for a VOD download, we see this as a valuable learning experience, expect stumbles on the way to greatness, and believe this will drive a faster decision to make all content available to subscribers for a simple subscription fee.

Loeb signs off emphasizing the need for a quick transition to the company’s digital future.

We look forward to continuing a constructive dialogue.

Sincerely,

Daniel S. Loeb.

For Loeb and Country

Another notable trade from this most recent era is in chipmaker Intel—though not because of the position’s size. Third Point’s purchase of 1 million shares worth a total of $50 million don’t leave it with much voting power or the requirement of submitting a 13D. However, as with Disney, Loeb chose to publish one anyway.

Loeb’s letter is short and to the point: Intel has lost its dominance in the semiconductor market. Loeb says the company must regain it by shaking up its management—for the sake of the country as well as its shareholders. “Without immediate change at Intel,” Loeb writes, “we fear that America’s access to leading-edge semiconductor supply will erode, forcing the U.S. to rely more heavily on a geopolitically unstable East Asia to power everything from PCs to data centers to critical infrastructure and more.”

Loeb shows flashes of the venom from the decade earlier: “From a governance point of view, we cannot fathom how the boards who presided over Intel’s decline could have permitted management to fritter away the Company’s leading market position while simultaneously rewarding them handsomely with extravagant compensation packages…”

He reigns it in a bit though, allowing that the board chairman, Omar Ishrak, had only recently joined the board and therefore should not be held completely responsible for the state of the company.

After entering Intel at around $49, the stock now sits at roughly $56. The company has a new CEO as of February 2021, Pat Gelsinger (of whom Loeb approves). Loeb expects to be a long-term Intel shareholder.

Laser-Eyed Loeb

Loeb’s recurrent pattern of growth and return to first principles has characterized his career. Now, at 59 years old, Loeb is still working to expand his comfort zone. Nowhere is this better evidenced than on Twitter—where Loeb has become a champion of cryptocurrency.

I’ve been doing a deep dive into crypto lately. It is a real test of being intellectually open to new and controversial ideas. Culturally I compare bridging the crypto world with the old as akin to finding a portal @chbetween two distinct worlds in the multiverse.

@cdixon is a brilliant mind and I enjoyed this article as an art collector and investor.

Also, maintaining healthy skepticism while also deepening one’s understanding requires one to engage in what Steve Jobs (and Fitzgerald before him) described as requisite for a superior intellect: “to maintain two opposed ideas in ones mind and retain the ability to function”

Another conflict to overcome is the idea that being late to the crypto party will inevitably lead to one taking the sucker seat at a high stakes poker table versus this still being early days in what is just now being adopted in the mainstream.

— Dan Loeb on Twitter (2021)

Twitter Loeb is Mr. Pink all grown up. The candor and the wisdom—pointing users to ideas he finds interesting, for example—remains. But gone is the name calling (see misunderstood use of “degen” below). He even shares reflective moments.

If I could advise my younger self, I would say to avoid such confrontational interactions and to treat everyone with kindness and respect. Lewis was clearly not a cultural fit for me or my firm, but there was no need to engage like that or share. Seems immature in hindsight.

— Dan Loeb on Twitter (2021)*

*Written in response to a tweet that resurfaced his email exchange with former Third Point interviewee Alan Lewis

No problem. I figured something triggered you or you were having a bad day. I’ve been spending time with the crypto community where the term “degen” is a compliment and badge of authenticity. Also I like melon.

— Dan Loeb on Twitter (2021)

On Twitter, Loeb straddles the worlds of traditional investing and crypto. Fault lines have opened up between the two, for example around the communities’ respective stances on Warren Buffett and Charlie Munger. Munger has called crypto “rat poison” and Buffett “rat poison squared.” Still beloved by the traditional investing community, Buffett and Munger have been portrayed as out-of-touch fogies by crypto world.

It’s clear that Loeb reveres Buffett and Munger, having quoted them repeatedly over the years. But he’s not afraid to push back on ideas that he disagrees with—their rejection of crypto and Buffett’s 2015 denunciation of hedge funds and activists investors are prime examples.

This discourse has seen a different side of Loeb emerge—Dan Loeb, seeker of nuance.

In the exchange below, despite his broad disagreement with Munger’s position, he still offers the following defense.

We need to stop listening to Buffet and Munger for investing advice. Software changed the game and left them behind.

Performance since 2008 crash, when Buffet notoriously struck "sweetheart" deals:

* Nasdaq : +848%

* SPY: +444%

* Berkshire: +388%

— @avichal on Twitter (2021)

Dan’s Response:

@avichal Munger is a man of great wisdom whose commentary and writings are an indispensable part of the investing canon. One idea I think is essential to push back on is “invest in what you know”. This is a fundamental Mindset flaw and surprised this view is being ascribed to Munger, a life long learner. Some of our best investments have been in areas I knew nothing about like Sovereign debt trades in Greece and Argentina, structured credit starting in ‘07 (short then long) and privates/VC. We don’t Ape into these things but do the requisite work to familiarize ourselves with the fundamentals and market structure of these new areas. I trust our efforts in digital currencies, blockchain and Defi will pay off. Sometimes the bigger risk is not being involved than staying in your comfort zone on the sidelines. 💎🙌🚀

— Dan Loeb on Twitter (2021)

Lest Mr. Pink fans despair, the Loeb of old is still out there—somewhere.

He liked this response to one of his now-deleted tweets:

@DanielSLoeb1 A billionaire casually trolling Nasdaq investors is one of the reasons I joined Twitter

— @DustryTerminal on Twitter (2021)

He also liked the following tweet:

Daniel Loeb is the OG troll, he was spitting put-downs on msg boards back when Internet Explorer 5 was the order of the day. That instinct is not going to go away

— @justbrosef on Twitter (2021)

And responded with now-deleted tweet of his own:

“A leopard never changes his spots… ”

— Dan Loeb on Twitter (2021)

CONCLUSION: The real Loeb is learning to do a handstand

A few months before starting Third Point, Loeb began practicing a form of yoga called Ashtanga yoga. Most think of yoga as a calming, if slightly woo-woo, activity. Coverage of Loeb often mentions his yoga habit as a contrast to his ‘wolf of wall street’ persona.

Ashtanga yoga is a bit different, though. It’s an athletic, highly demanding practice. Its founder, K. Pattabhi Jois, was known for giving his students such violent “adjustments” to their poses that he would sometimes cause serious injury. Ashtanga—practiced at 5:30 in the morning as Loeb is known to do—requires grit, determination, and strength. It’s not for the faint of heart.

Neither are Loeb’s other pastimes. He has competed in multiple triathlons, including an episode in which he challenged three Navy SEALs. He also surfs. A lot.

His devotion to these activities is no mere passing fad. Five months after starting Third Point in 1995, Loeb traveled to India to study yoga with a master teacher for a full month. Contrary to the popular connotations of these activities, Loeb says, they have been essential in making him a more effective manager.

[Going to India] was an unusual decision. In fact, I got a call from one of my friends, a competitor in the business, who said, “Don’t do that. That’s a huge mistake. Everyone’s going to think you’re a flake for leaving your business, going to India, studying yoga for a month.” Mind you there were no internet connections then, cell phone service was nonexistent; the concerns were well founded. So I went anyway, had a great month there. It launched me into really a lifelong passion for spirituality, for contemplation, meditation, and I just want to say that these things aren’t just for monks and for hermits. They can really improve all of our lives and they can improve us as business people as well.

— Dan Loeb at the American Enterprise Institute (2014)

Loeb believes so deeply in physical and emotional health that he has crafted opportunities for his team members to pursue similar endeavors of their own.

I think if you are physically fit... your judgment is better, your energy levels are better. And we sponsor anybody who wants to compete in a triathlon… I got a random email from a guy in the accounting department who I don't have a lot of interaction with…And he said, Dan, thanks so much for sponsoring the triathlon. You motivated me to do it. And since then, I've lost 50 pounds. I'm doing a half marathon and I'm doing another one. And I was a football player in college and I just had lost my way, and thank you. That's a great feeling to know that you can have that impact on people's lives…

— JEC Speech (2009)

Loeb has also received attention for his sprawling philanthropic profile.

It just feels really good when you've seen the impact, whether it's supporting this organization and seeing all you guys getting together and knowing the good that's come or other things that we've supported, it makes you feel good.

— JEC Speech (2009)

As in his other professional and personal endeavors, Loeb doesn’t tread lightly in the philanthropic space. He has called his philanthropic style “activist philanthropy,” dubbing it a “hard hitting” team sport.

He has supported education reform as an ardent cheerleader for charter schools. He currently sits on the board of Success Academy Charter Schools, a school operator in New York. He’s also given substantial support to Jewish and Israel causes, criminal justice reform and LGBT rights.

In his activist philanthropy, Loeb leans on many similar analytical tools he uses to gauge the impact of the investments he makes at his day job, including constant learning and the use of “evidence, data, and logic” to evaluate the efficacy of every decision.

it isn’t enough to give. One must work at giving, search for and support causes and organizations that address structural problems, advance social progress, and transform people’s lives.

— Dan Loeb Effective Giving Op-ed in the Wall Street Journal (2020)

Through his philanthropic work, Loeb has also furthered a series of relationships with other prominent hedge funders, including Carl Icahn. In 2014, Loeb gave $15 million to the Icahn School of Medicine at Mt. Sinai to establish the Ronald M. Loeb Center for Alzheimer’s Disease, in honor of his father who passed away from Alzheimer’s.

I’m here not as a businessman but as a philanthropist.

— Dan Loeb at the Criminal Justice Summit (2018)

He has also worked closely with fellow activist investor Paul Singer, also the chairman of the Manhattan Institute, a New York-based conservative think tank, on his political agenda. After supporting his former Columbia classmate Barack Obama in 2008, Loeb is now a major donor to Republican candidates across the country.

As Churchill supposedly said: if you are not a liberal at 20, you have no heart, and if you are not a conservative at 40, you have no brain. It took me a little bit longer but Paul, thanks for helping me make this change. How fortunate I have been to have a mentor who combines the best qualities of Dick Cheney and Darth Vader.

— Manhattan Institute Hamilton Awards Speech (2020)

Loeb is also known for talking about the importance of his family. He married his wife, Margaret Munzer Loeb, in 2004. She shares in the practice of yoga and is a trained social worker. Together they have two children.

Lastly, whatever measure of success I have attained in my professional career would not have been possible without the love and support of my wife Margaret and pales in comparison to the happiness she and my children give me every day.

— Columbia College Alumni Association John Jay Awards Speech (2012)

Loeb ends his JEC speech by thanking his wife for coming, with a little jab. “I’ve never spoken so much in a time that my wife so little, probably in our entire marriage. So thank you, honey, for coming.”

Loeb had opened the same speech by reflecting on the universality of stories. Everyone has one, he told the audience. And the quality of those stories do not automatically correspond to social position.

What he doesn’t say is that he’s thought a lot about stories. He’s been shaped by the story of his family, by the greatest stories known to humankind—those of Homer, Plato, and Virgil—and by his own stories about himself.

The other thing I wanted to talk about story is not just a story involving your life, but then, we also tell ourselves stories that come out of our life experience. I'm Dan, I'm a good investor, I'd like to be a better surfer. I'm good at this, bad at that. But sometimes these things set our expectations of life and really determine what we can do. I'm a little older than you guys. So my grandparents had stories about the Depression, about World War II. They had relatives that suffered in Nazi concentration camps. And those stories really affected them. They aren't [the source that?] made them who they are, but really affected kinds of decisions they made, their perceptions of the world, and their basic practices.

— JEC Speech (2009)

Whether about Mr. Pink, the all-knowing online stock picker, or about failed management, Loeb is in the business of crafting stories. If distressed assets occupy the center of his circle of competence, storytelling is there just to one side as well. In a 2010 investor letter, Loeb lets on just how conscious he is of the power of story with the following analysis of an interview with then-Fed chairman Ben Bernanke.

What was most striking in the interview was Chairman Bernanke’s devotion to the righteousness of his narrative at a time when every actor in the financial system still ought to be asking how things went so terribly wrong. The desire to create a story that emancipates one from blame and promises future forecasting precision must be incredibly powerful for any public servant charged with the awesome responsibilities of the Fed Chairman. Yet it is precisely these sorts of leaders who should be the most attuned to understanding the dangers of believing too much in the stories we tell ourselves, and instead be willing to search out facts and admit wrongdoing.

— Third Point Investor Letter Q3 2010

Stories have defined Loeb’s rise. The story of the CEO-vanquishing hedge fund manager rocketed him to fame. The one about a lifelong learner searching for value the world over has kept him there, delivering returns year after year.

Unlike the narrative arcs of his legendary letters, Loeb’s story isn’t so clean. The absolute truth of it isn’t easy to come by. And he’s okay with that.

From an investor’s point of view, our challenge is not only to keep up with rapidly unfolding events around the world, but also to keep our perspective fresh and differentiated from that of our competitors. As securities analysts we are truth seekers and problem solvers. We must satisfy ourselves with determining ranges of outcomes and potential scenarios rather than searching for, and ultimately fabricating, absolute truths. The only thing we are 100 percent confident in is that we are fallible, we don’t have all the answers, and we will make some mistakes.

— Third Point Investor Letter Q3 2010

It means a lot to us you’ve read this far! Thank you.

This has been the first chapter of Cloud Valley. We’re building the world’s first cloud museum; a collection of stories about the all-time greats of investing, business and tech. We’ll be exploring their defining moments, investments, and life decisions to understand how they tick.

You are an essential part of this journey. Feel free to share feedback, suggestions for future subjects, or just say hello anytime. We look forward to meeting you.

If you like what we’re doing, please make sure to subscribe and share with your friends.

Until next time,

KG and DS

In-depth and unique analysis! I've collected some of Dan's letters, some great ones were Ligand and Pogo - which would work really well for part 2.

https://www.tahadharamsi.com/memos/dan-loeb-activist-investor-letters/

Wow guys. This was outstanding. Thank you for putting this together. I learn a LOT! ...Can I be so bold as to ask you to.... DO MORE OF THEM!!! 🤘❤😁